📢 Headline Alert: Stay informed with curated news directly from top media sources.

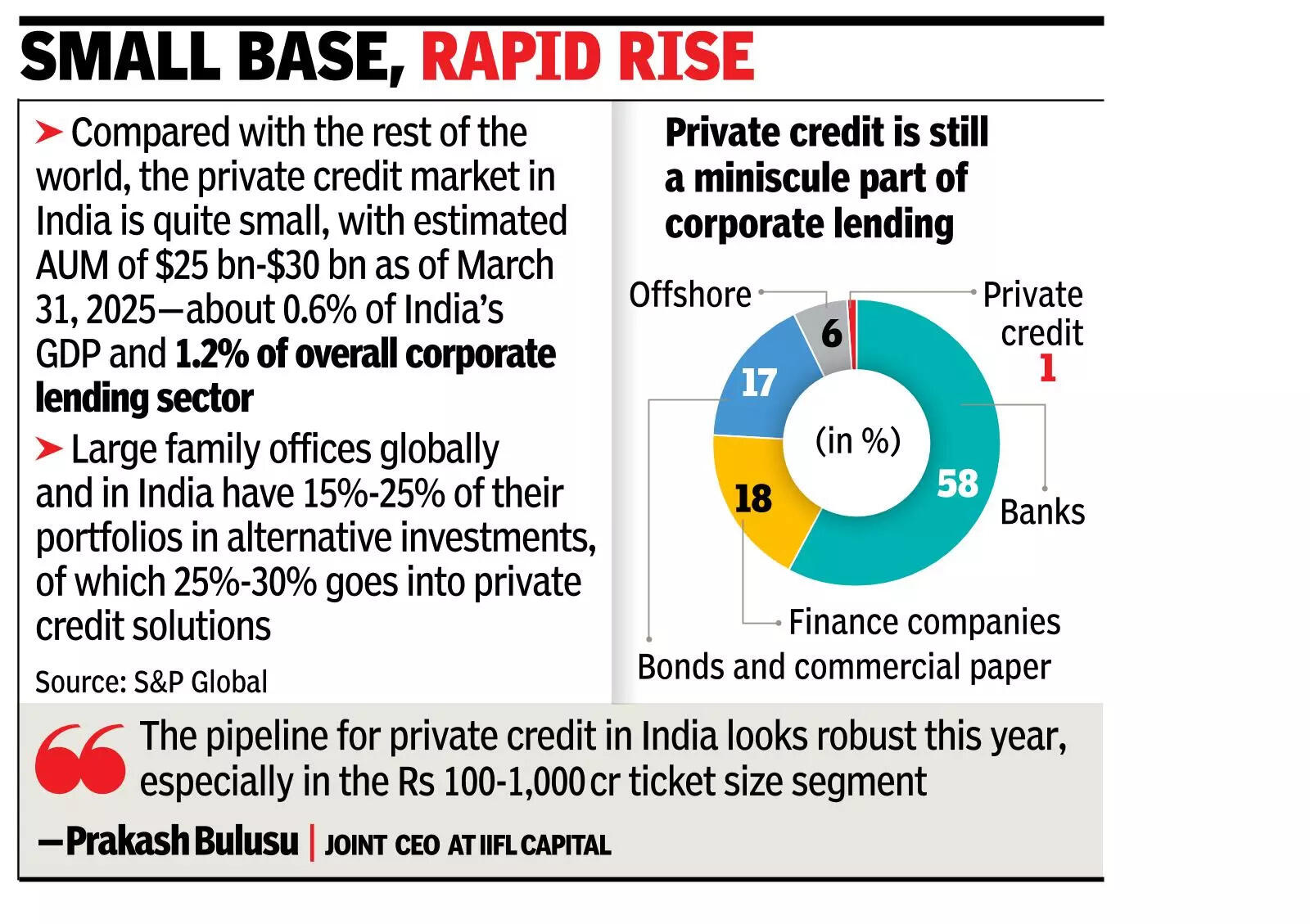

MUMBAI: India’s high-net worth individuals (HNIs) and rich family offices are increasingly betting on private credit deals in search for higher, predictable returns. Investing in the space, which grew to a nearly $13 billion market locally in 2025 also allows them to diversify their portfolio. “Regulatory and tax changes have made debt mutual funds less attractive while Sebi regulated alternative investment fund (AIF) structures provide comfort and scale to investors,” said Nilesh Dhedhi, MD & CEO at Avendus Finance.Private credit essentially is debt financing provided by non-bank lenders to largely mid-market companies. Large family offices globally and in India have 15%-25% of their portfolios in alternative investments of which 25%-30% goes into private credit solutions, S&P Global said in a note last year.

Small base, rapid rise

Most private credit platforms in India are structured as category II AIF entities, governed by Sebi. “In an environment where public equity can be volatile, and bond yields may not fully compensate for inflation and credit risk, private credit offers visibility, security and yield. Additionally, many HNIs appreciate the ability to invest in with tangible assets and strong covenants backing their capital,” said Prakash Bulusu, joint CEO at IIFL Capital.What’s fueling the rise of private credit in the first place is the fact that banks are not being able to fulfil all kinds of requirements, leaving a funding gap for mid-market structured credit, said Dhedhi. “Private credit can provide non-dilutive capital that can be tailored to specific needs of each borrower. There are multiple end-uses for which companies across the spectrum raise private credit added Amit Dharod, MD, alternative assets at JM Financial AMC. Private credit instruments grew between 40%-50% in 2025 over the previous year, said Dharod. While foreign capital helped start the momentum, the real push has come from domestic investors including HNIs and family offices, said asset managers. Vivriti Asset Management has made 10 investments across sectors in the past 7-8 months, said chief investment officer Soumendra Ghosh.The pipeline for private credit in India looks robust this year, especially in the Rs 100-1,000 crore ticket size segment, said Bulusu. “We are seeing dozens of active mandates at any given point, with aggregate deal activity running into several tens of thousands of crores annually,” said Bulusu, adding that activity is high in manufacturing, renewables, real estate, logistics, financial services, healthcare sectors alongside select technology-led businesses.

Source: Times of India

📝 We use smart aggregation to bring you top news in real-time.