📢 Headline Alert: Stay informed with curated news directly from top media sources.

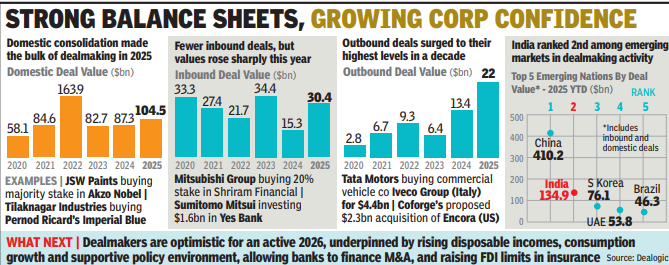

MUMBAI: India’s dealmaking activity is expected to keep up the pace next year after a strong run in 2025. Domestic consolidation hit $104 billion this year, its strongest showing in two years, while inbound deals climbed to $30 billion as banks from East Asia and the Middle East acquired stakes in Indian lenders. Outbound deals surged to $22 billion this year, the highest in a decade, led by overseas acquisitions by Tata Motors and Tega Industries. Among emerging markets, India ranked second, behind China’s $410 billion, according to Dealogic.“In 2026, we anticipate continued momentum in mergers and acquisitions (M&As), driven by strong balance sheets and growing corporate confidence,” said S Sundareswaran, Morgan Stanley’s India head of M&A.While financial services, technology, and healthcare have traditionally dominated deal flow, a broader range of sectors is expected to participate next year, Sundareswaran said. “Activity will be fuelled by both domestic players and global strategic acquirers, with inbound M&A expanding beyond financial services and industrials, despite occasional exits by foreign players.”Domestic consolidation will continue to be a key theme as Indian corporates pursue strategic growth locally while selectively exploring international opportunities, said Amit Thawani, Nomura’s India head of investment banking.

Strong balance sheet, growing Corp. confidence

The makeup of M&A participants is also shifting. “While conglomerates have traditionally led domestic consolidation, we are increasingly seeing mid-cap companies that were virtually absent in this type of consolidation also entering the M&A arena,” Thawani said, citing Mankind Pharma’s takeover of Bharat Serums and Vaccines, Tilaknagar’s buy of the Imperial Blue brand, and Jubilant’s acquisition of Hindustan Coca Cola Beverages as recent examples.“Inbound M&A will continue in sectors such as financial services, consumer, and infrastructure, which remain attractive to foreign investors over the long term,” said Rahul Mody, co-head of investment banking at Ambit.However, inbound M&As are transitioning from a volume-driven to a value-driven model. “While deal volumes have declined over the past three years, transaction values rose sharply this year, signaling that foreign investors are becoming more selective while committing larger sums per deal,” said Sumeet Abrol, partner at Grant Thornton Bharat, adding that “Investments are also concentrated in policy-aligned sectors including financial, manufacturing and energy.”Mitsubishi UFJ Financial Group of Japan’s $4.4 billion acquisition of a 20% stake in Shriram Finance was the year’s largest inbound deal in the financial sector. Dubai-based Emirates NBD followed with a $3 billion investment in RBL Bank, while Japan’s Sumitomo Mitsui Banking Corporation injected $1.6 billion into Yes Bank.The next year could see the privatisation of IDBI Bank as India plans to cut the number of public sector banks from 12 to four or six. Fairfax Group and Kotak Mahindra Bank have shown interest in IDBI Bank, highlighting the growing interest in financial services. Dealmakers’ optimism for an active 2026 is underpinned by rising disposable incomes, consumption growth, and a supportive policy environment. India has taken steps to boost dealmaking by allowing banks to finance M&A transactions, raising foreign direct investment limits in insurance, and permitting direct share swaps between Indian and foreign companies.The proposed $2.3 billion overseas acquisition of Encora by Indian IT firm Coforge will be among the first listed-space deals under revised foreign exchange rules allowing overseas shareholders of Encora to indirectly own a stake in Coforge. Previously, Indian companies were barred from issuing shares to foreign owners in exchange for overseas assets, effectively preventing non-cash deals.Bharat Anand, senior partner at Khaitan & Co said expectations of lower US Fed interest rates could further support dealmaking, adding to dealmakers’ optimism for 2026, as reduced borrowing costs typically boosts M&As.

Source: Times of India

📝 All news content is syndicated with source attribution for transparency.